-

Anglický jazyk

Anglický jazyk

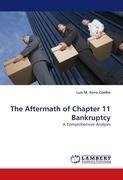

The Aftermath of Chapter 11 Bankruptcy

Autor: Luís M. Serra Coelho

Finance scholars disagree on how real world financial markets work. According to the traditional paradigm in finance, on average, market prices reflect fundamental value. Conversely, behavioural finance theory suggests this may not be the case since... Viac o knihe

Na objednávku, dodanie 2-4 týždne

71.54 €

bežná cena: 81.30 €

O knihe

Finance scholars disagree on how real world financial markets work. According to the traditional paradigm in finance, on average, market prices reflect fundamental value. Conversely, behavioural finance theory suggests this may not be the case since investors are not fully rational and arbitrage is both risky and costly. This book adds to the discussion by investigating how the U.S. equity market deals with the announcement of bankruptcy, the most extreme event in the corporate domain. My results can be summarized around three key ideas. First, on average, the market does not price the full impact of a bankruptcy announcement in a timely manner. Second, limits to arbitrage help explain why such market pricing anomaly subsists even in the longer-run. Finally, the specific reason for filing for Chapter 11 seems to have a very significant impact on how the market deals with the announcement of bankruptcy. This book should be relevant for both academics interested in the fields of bankruptcy and behavioural finance and institutional and individual investors who trade bankrupt firms' securities.

- Vydavateľstvo: LAP LAMBERT Academic Publishing

- Rok vydania: 2011

- Formát: Paperback

- Rozmer: 220 x 150 mm

- Jazyk: Anglický jazyk

- ISBN: 9783844322651